Like a surfer, 'the search' for the perfect wave always remains

The Gallantree Story

An organically growing mission to elevate industries in Australia and to be the boutique investment firm of choice for those who aim to innovate and grow.

Why Gallantree exists?

Gallantree was established as a cause or more appropriately, as a mission to offer great Australian businesses or projects a place to access capital that they would normally have to get on a plane to find.

The team at Gallantree have worked for domestic and international banks, for private capital providers, Big 4 advisory, and were frustrated by the lack of available debt and equity offerings that could compete internationally and didn’t have ‘cookie cutter’ strategies.

This is true in Australia, and for us in Queensland, we are always behind the eight-ball from the start. Very few Sydney and Melbourne funders wanted to invest in QLD businesses or projects which came as a shock to us.

Formally, we kicked off Gallantree in 2021 and we knew roughly what we wanted to do however we needed to validate it with the best capital providers and family offices in Australia, and abroad in places like Singapore, London, Zurich or New York. We met over 200 funders – on both debt side and equity side. We met advisors, stockbrokders, wealth managers, bond issuers, fund of fund arrangers, vc-firms, PE firms, non-banks, banks, investment houses, you name it, we met them.

We noticed for many funders, they had not only a one-dimensional outlook, but one-dimensional capital stack, usually beholden to the capital provider, and this was usually not in-tune with where the capital was destined for. Most of all, some of the 'class-leading' capital providers need a strong dose of risk management, but what we saw made them only competitive if there was limited competition. Many fund managers or wealth managers lacked optimism.

Most funders saw themselves as the smartest people in the room, however if you read Simon Sinek, you’ll see both employees and capital providers must work in unison in order to achieve more.

If our goal is to build companies that can keep playing for lifetimes to come, then we must stop automatically thinking of shareholders as owners, and executives must stop thinking that they solely work for them. A healthier way for all shareholders to view themselves is as contributors, be they near-term or long-term focused. Whereas employees contribute time and energy, investors contribute capital (money). Both forms of contribution are valuable and necessary to help a company succeed, so both parties should be fairly rewarded for their contributions.

With this in mind, we found our just cause and since then we have been working on bringing a class leading investment bank to Brisbane suited to being an expert in industry, not just providing ‘off the shelf’ products and services. Essentially bringing back tailored and flexible capital sources and relationship driven, Austrian style banking (without being a Bank) to the sunny Queensland shores.

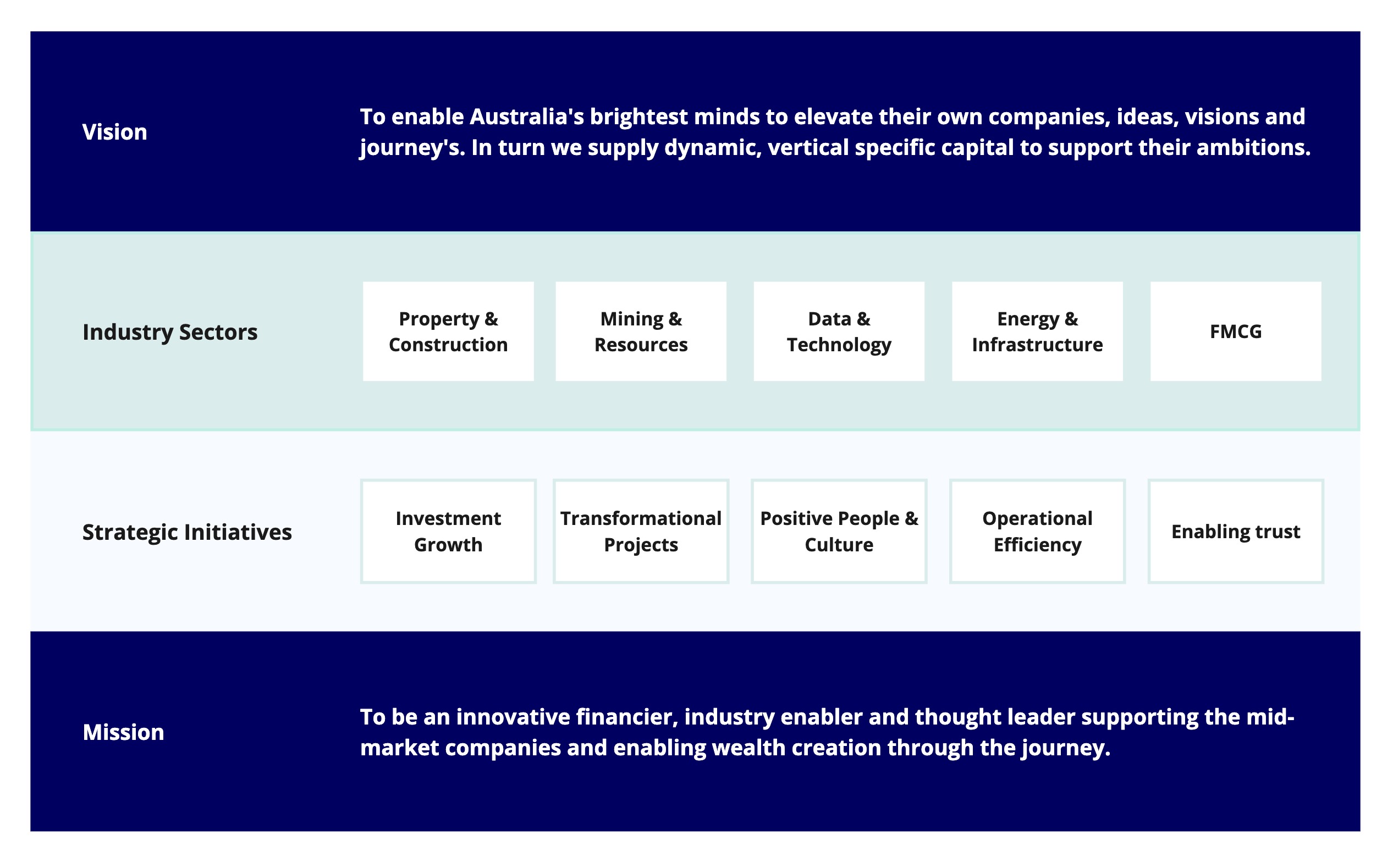

The mission

The mission and vision of Gallantree is to elevate industries in Australia by blending a sophisticated capital offering together with strategic advisory services to elevate each project or business.

This will enable higher risk adjusted returns over our competitors.